Europe:

To remove the VAT from your order, please refer to the following two steps:

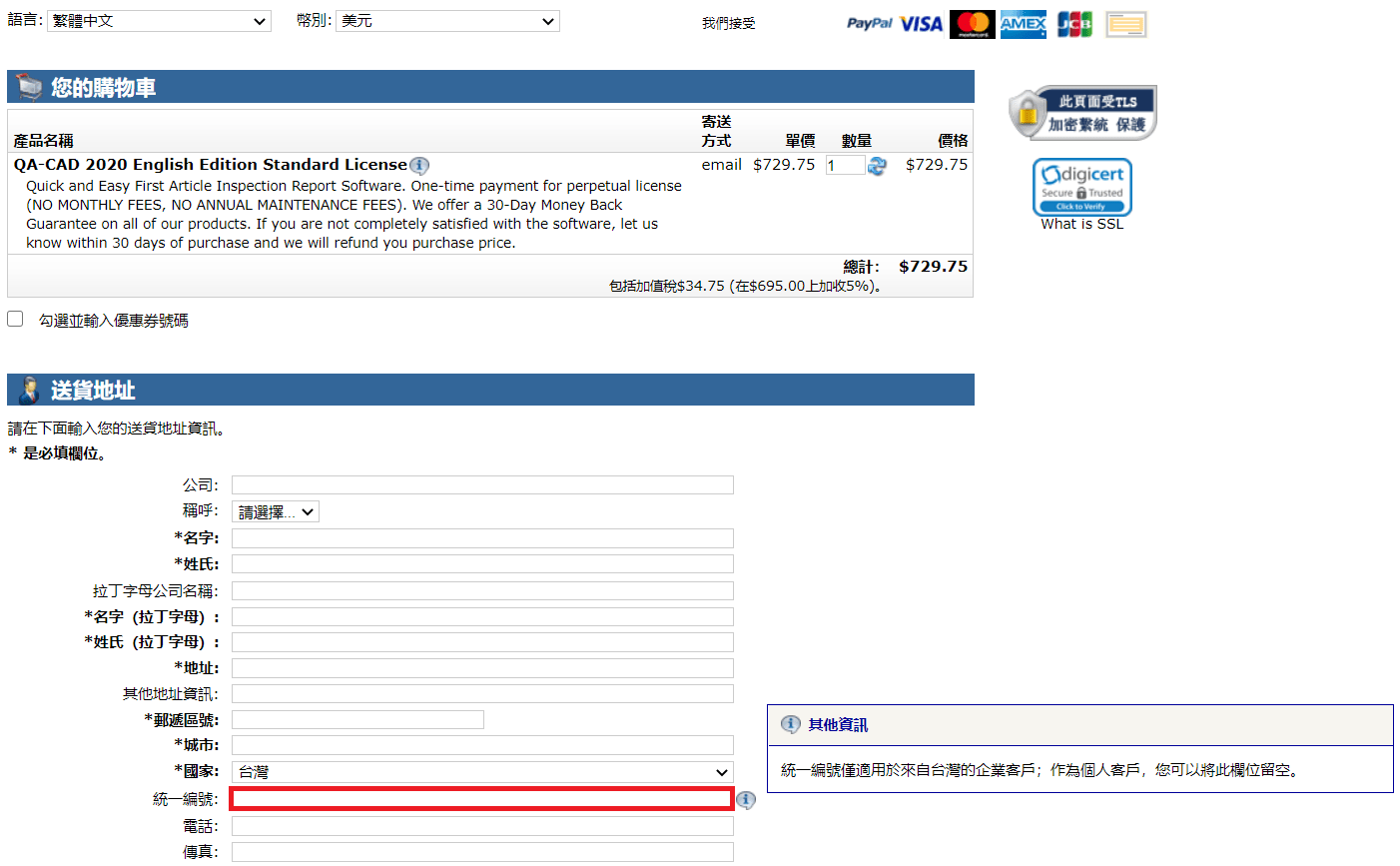

1. Fill in your VAT ID and the VAT will be removed once the VAT ID is verified.

Note: If the VAT ID is reported as invalid and you are certain it is correct, please contact our order process: payment@cleverbridge.com for further assistance.

Click here to open the QA-CAD network license online shop

Click here to open the QA-CAD LT standard license online shop